Fundamental analysis is a powerful tool for investors seeking to make informed decisions in the stock market. By delving into a company’s financial health and economic prospects, investors can identify stocks with strong potential for growth. In this comprehensive guide, we will explore the principles of fundamental analysis, various techniques, mathematical formulations, and essential tips to help you navigate the complex world of stock investing.

Understanding Fundamental Analysis

Fundamental analysis involves assessing the intrinsic value of a stock by analyzing the underlying financial and economic factors. Here are the key components and steps involved:

- Financial Statements Analysis:

- Income Statement: Examine revenue, expenses, and profits to gauge a company’s profitability.

- Balance Sheet: Assess assets, liabilities, and equity to understand the financial position.

- Cash Flow Statement: Analyze cash inflows and outflows to determine liquidity.

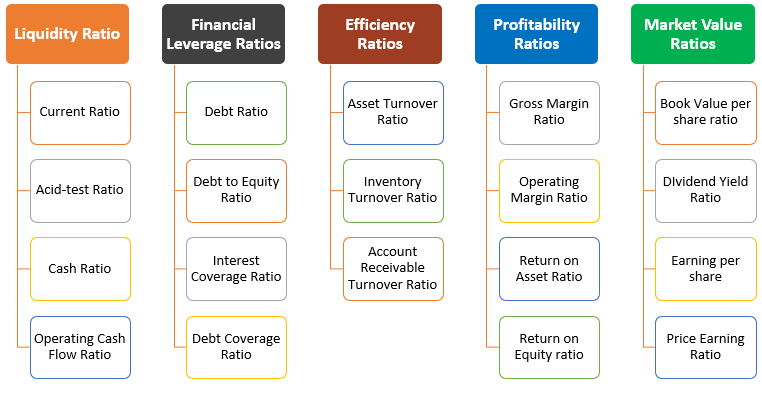

- Earnings Per Share (EPS):

- Calculate EPS by dividing the net income by the number of outstanding shares. Higher EPS indicates better profitability.

- Price-to-Earnings (P/E) Ratio:

- Calculate the P/E ratio by dividing the stock price by EPS. It helps assess a stock’s valuation compared to its earnings.

- Debt-to-Equity Ratio:

- Determine a company’s financial leverage by comparing its debt to its equity. Lower ratios are generally preferred.

- Dividend Yield:

- Calculate the dividend yield by dividing the annual dividend per share by the stock price. High yields can indicate income potential.

- Growth Prospects:

- Analyze industry trends, market potential, and a company’s competitive position to predict future growth.

Techniques and Mathematical Formulations

- Discounted Cash Flow (DCF) Analysis:

- Estimate a stock’s intrinsic value by discounting future cash flows back to their present value. The formula is: Intrinsic Value = Sum of (Expected Future Cash Flows / (1 + Discount Rate)^n)

- Relative Valuation:

- Compare a stock’s financial ratios (P/E, P/B, etc.) to those of similar companies or industry averages.

- Earnings Growth Rate:

- Calculate the expected earnings growth rate using historical data or analyst estimates.

- Dividend Discount Model (DDM):

- Determine the fair value of dividend-paying stocks by discounting expected future dividends. The formula is: Intrinsic Value = Dividend / (Discount Rate – Dividend Growth Rate)

- Price-to-Book (P/B) Ratio:

- Compare a stock’s market value to its book value (total assets – total liabilities).

For more information on Financial Ratios, visit QuantEdX

Limitations of Fundamental Analysis

Fundamental analysis is a widely used approach to evaluate investments by analyzing the underlying economic and financial factors of a company or asset. While fundamental analysis can provide valuable insights into the long-term prospects of a company, it has certain limitations that may make it challenging for traders to rely solely on this approach. Here are some reasons why fundamental analysis can fail for traders:

- Short-term Volatility: Fundamental analysis focuses on assessing the intrinsic value of a company or asset, considering factors such as financial statements, industry trends, and competitive analysis. However, in the short term, market prices can be heavily influenced by external factors, sentiment, and market speculation, leading to price volatility that may not reflect the underlying fundamentals accurately.

- Market Inefficiencies: Financial markets are not always perfectly efficient, meaning that prices may not always accurately reflect the available information. Market inefficiencies can arise due to factors like information asymmetry, behavioural biases, and market manipulation. These inefficiencies can undermine the accuracy of fundamental analysis, as market prices may deviate from the expected valuations.

- Time-consuming Research: Fundamental analysis requires significant research, including analyzing financial statements, industry reports, news, and macroeconomic factors. Gathering and analyzing this information can be time-consuming, particularly for individual traders who may not have access to sophisticated research resources or dedicated teams. As a result, fundamental analysis may not provide timely insights for short-term trading decisions.

- Subjectivity and Interpretation: Fundamental analysis involves making judgments and assumptions based on available information. Different analysts may interpret the same data differently, leading to subjective assessments of a company’s value or prospects. Additionally, factors such as accounting practices, estimates, and subjective valuations can introduce a level of uncertainty and variability in fundamental analysis.

- Unforeseen Events: Fundamental analysis relies on historical data and assumptions about the future, but it cannot predict unforeseen events or black swan events that can significantly impact the market. Factors such as natural disasters, political instability, regulatory changes, or disruptive innovations can disrupt the expected outcomes and render fundamental analysis less effective in these situations.

- Market Psychology and Sentiment: The behaviour and sentiment of market participants can influence short-term market movements. Market psychology, including fear, greed, and herd mentality, can drive prices away from their fundamental values. These behavioral biases can lead to market bubbles, irrational price movements, and situations where fundamental analysis may not accurately predict short-term price trends.

For articles on High-Frequency Trading, Visit us at QuantifiedTrader/HFT

Conclusion

It is important to note that while fundamental analysis may have limitations for short-term trading decisions, it remains a valuable tool for long-term investors who focus on the underlying fundamentals of a company. Traders often combine fundamental analysis with other approaches such as technical analysis or sentiment analysis to gain a more comprehensive understanding of market dynamics and make informed trading decisions.