Automated trading is a trading approach that involves the use of computer algorithms and technology to automate various aspects of the trading process. It eliminates or reduces the need for manual intervention by traders, as the system executes trades automatically based on predefined rules and parameters.

In automated trading, the entire trading process is automated, including decision-making, order creation, order submission, and order execution. This means that the system can analyze market data, identify trading opportunities, and execute trades without human involvement. It also incorporates quantitative modeling, which involves using mathematical and statistical models to analyze market data and develop trading strategies.

Automated trading systems are utilized by a wide range of market participants, including trading firms, banks, hedge funds, asset managers, and pension funds. These entities may either develop their own proprietary automated trading systems or use systems provided by third-party vendors. The level of automation can vary among systems, influenced by factors such as regulatory requirements, stock exchange rules, and cultural norms.

By employing automated trading systems, market participants can benefit from increased efficiency, speed, and accuracy in executing trades. These systems can rapidly analyze vast amounts of market data, react to market conditions in real-time, and execute trades with minimal delays. However, it’s important to note that automated trading also carries certain risks, such as technical glitches, connectivity issues, and the potential for unintended consequences due to complex algorithms.

Overall, automated trading has become an integral part of modern financial markets, offering market participants the ability to leverage technology and sophisticated algorithms to optimize their trading strategies and enhance their overall performance.

The Architecture of Automated Trading System

The architecture of an automated trading system has evolved from the traditional manual trading process to a more advanced and efficient system. The following article explains the architecture of an automated trading system, with a focus on the components involved.

The traditional trading system involved interactions between brokers and exchanges for receiving market data, sending order requests, and receiving replies. Traders had to approach brokers to manually buy and sell financial instruments, which was time-consuming and prone to emotional decision-making.

The advent of automated trading brought about significant changes and improvements. In its basic form, the automated trading system receives market data from the exchange, which includes information such as the latest order book, volume traded, last traded price, and quantity of trading orders. The system analyzes historical data and patterns to create a trading strategy and execute trades.

The architecture of the automated trading system can be broken down into several components. These include:

- The Exchange(s): This component represents the external world from where market data is received.

- The Server: This component plays a crucial role in the automated trading system. It receives market data, stores it, and stores orders generated by the user. It acts as the central processing unit of the system.

- Application: The application layer takes inputs from the user, such as stop loss, limits, and preferred financial instruments for trading, and provides an interface for viewing information, including data and orders. It also acts as an order manager, sending orders to the exchange.

The architecture also includes additional components and considerations:

- Risk Management System (RMS): To ensure proper risk management, the RMS performs risk checks within the application layer and before generating orders in the order management system. This helps prevent erroneous inputs and mitigate potential risks.

- Market Adapter: The market adapter converts the format of data received from the exchange into a format that the trading system can understand. It is responsible for integrating with the exchange’s API and transforming the data accordingly.

- Complex Event Processing Engine (CEP): This component processes incoming events, such as stock trends, market movements, and news, in real-time. It performs complex calculations, statistical analysis, and decision-making based on predefined trading strategies.

- Order Routing System: This component encrypts the order in a language understood by the exchange and handles the transmission of orders to different destinations. It utilizes exchange-specific APIs or the FIX protocol for efficient data flow.

- Order Management System (OMS): The OMS executes buy/sell orders based on predefined logic and contains different execution strategies such as VWAP (Volume-Weighted Average Price) and TWAP (Time-Weighted Average Price). It manages processes like order routing, encoding, and transmission.

Overall, the architecture of an automated trading system involves the integration of various components that work together to receive market data, process it, generate trading strategies, and execute orders. Risk management plays a critical role in ensuring the system’s stability and preventing potential losses.

Automated Trading System Protocols: Streamlining Connectivity and Efficiency

The architecture of automated trading systems has evolved to cater to the need for scalability and connectivity with multiple destinations. In the past, the system required separate adapters for each exchange, as each exchange had its own communication protocol optimized for its specific features. This meant that adding a new exchange to the system necessitated the design and integration of a new adapter, resulting in additional effort and time.

To overcome these challenges and simplify connectivity, standard protocols have been developed, with the FIX (Financial Information Exchange) protocol being the most notable. The introduction of standard protocols enables the automated trading system to seamlessly connect with different destinations without the need for individual adapters for each exchange. This not only streamlines the integration process but also significantly reduces the time required to connect with new destinations.

The utilization of standard protocols offers several advantages for automated trading systems. Firstly, it facilitates integration with third-party vendors for analytics and market data feeds. By adhering to a common protocol, the system can efficiently collaborate with external providers, enhancing its analytical capabilities and data-sourcing options. This fosters an environment of interoperability and allows for seamless integration with a wide range of vendors, thereby increasing the system’s flexibility.

Moreover, the presence of standard protocols simplifies the simulation process. By utilizing the FIX protocol, the automated trading system can easily receive data from the real market and transmit orders to a simulator. This feature enables traders and developers to test and validate their strategies in a controlled environment before deploying them in live trading scenarios. Whether using an in-house simulator or procuring one from a third-party vendor, the system’s adapters remain agnostic to the source of the data, be it the live market or a recorded dataset.

The introduction of standard protocols not only enhances connectivity but also contributes to the overall efficiency of the market. With reduced constraints in connecting to new destinations, the system can readily access a broader range of exchanges and vendors. This improved efficiency benefits market participants by providing them with a wider choice of trading venues and data sources. It also encourages competition and innovation among exchanges and vendors, as connectivity is no longer a significant barrier for market participants.

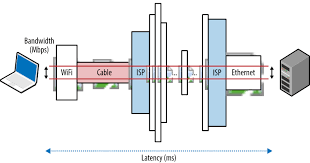

Low Latency Architectures: Enhancing Speed and Efficiency in Automated Trading Systems

Automated trading systems have revolutionized the financial industry by enabling real-time data processing and rapid decision-making. With the advancement of standard communication protocols like FIX (Financial Information Exchange), the barriers to entry for setting up algorithmic trading desks or automated trading systems have significantly reduced. As a result, the world of algorithmic trading has become increasingly competitive, prompting the need for low-latency architectures.

Latency, in the context of automated trading systems, refers to the delay experienced at various stages of data transmission and processing. Reducing latency is crucial for several reasons. Firstly, high-frequency trading strategies thrive in low-latency environments, where even milliseconds can make a significant difference in trade execution. Secondly, in a fiercely competitive market, slower systems are at a disadvantage, as faster competitors can exploit price discrepancies or market inefficiencies more effectively.

Addressing latency in an automated trading system requires a holistic approach that considers multiple factors. Let’s examine the life cycle of an automated trading system and the steps where latency can be optimized:

- Market data packet publication: The exchange publishes market data packets.

- Packet transmission: The packet travels over the network, reaching a router on the server side.

- Routing and forwarding: The router forwards the packet to the server’s Ethernet port.

- Packet processing: The server processes the packet, converting it into an internal format.

- Internal module traversal: The packet traverses different system modules, such as Complex Event Processing (CEP) and tick store.

- Order request generation: The CEP analyzes the data and generates an order request.

- Order transmission: The order request is sent back to the destination.

- Reverse path: The order request follows a similar path back to the market data packet.

Latency optimization typically begins with the first step, ensuring efficient packet transmission. Minimizing the physical distance between the exchange and the host server is essential, and collocations provided by exchanges offer proximity hosting options. By reducing the distance, the time taken for trade order execution decreases in terms of milliseconds (ms) and microseconds (μs).

Furthermore, kernel bypass technology offers advantages for single-destination high-frequency strategies. Collocation becomes a standard requirement for such strategies, but careful consideration is needed for multiple-destination strategies. Factors such as the destination’s reply time and the ping time between destinations should be evaluated to make an informed decision based on the strategy’s nature.

Latency in automated trading systems can also be impacted by propagation latency, network processing latency, serialization latency, interrupt latency, and application latency. Propagation latency, affected by the speed of light, can be optimized through innovations like microwave communication and laser communication, which minimize physical distance and introduce nanosecond-level improvements.

Network processing latency, introduced by routers and switches, can be reduced by optimizing the number of hops a packet takes from source to destination. Each additional hop introduces its own latency, making it crucial to minimize the number of intermediate devices.

Serialization latency refers to the time taken to transmit data on and off the wire. Higher bandwidths and more efficient transmission technologies significantly reduce serialization latency, enhancing overall system performance.

Interrupt latency, caused by interrupts generated during packet reception, can be mitigated through techniques like kernel bypass. By allowing packet processing directly in userspace, interrupts are avoided, leading to reduced latency and improved system responsiveness.

Application latency, dependent on factors such as packet complexity, processing allocation, programming efficiency, and hardware optimization, can be minimized by dedicating processors to essential application components and leveraging low-level programming languages. Some advanced systems even employ hardware-based calculations using Fully Programmable Gate Arrays (FPGA) for further latency reduction.

It is essential to note that reducing latency in automated trading systems requires a comprehensive understanding of the entire architecture and careful optimization at each stage. Moreover, cost and complexity increase as latency requirements become more stringent.

Advantages and Disadvantages of Automated Trading Systems

Automated trading systems, also known as algorithmic trading systems or trading robots, have gained popularity in the financial industry due to their potential benefits. However, like any technology, they come with advantages and disadvantages. Let’s explore both sides:

Advantages:

- Speed and Efficiency: Automated trading systems can execute trades at a much faster pace than manual trading. They can process vast amounts of data, analyze market conditions, and execute trades in real-time without human intervention. This speed and efficiency can lead to better trade execution and the ability to capitalize on market opportunities quickly.

- Elimination of Emotional Bias: Emotions can often cloud judgment and lead to irrational trading decisions. Automated trading systems follow pre-defined rules and algorithms, eliminating emotional bias from the trading process. This disciplined approach helps in maintaining consistency and sticking to the trading strategy even during volatile market conditions.

- Backtesting and Optimization: Automated trading systems allow for extensive backtesting and optimization of trading strategies. Historical data can be used to test strategies and fine-tune parameters to enhance performance. This helps traders in gaining confidence in their strategies before deploying them in live trading environments.

- Continuous Monitoring: Automated trading systems can continuously monitor the market, tracking multiple instruments and indicators simultaneously. They can instantly react to changes in market conditions and execute trades accordingly. This ensures that trading opportunities are not missed, even during times when manual monitoring would be challenging.

- Reduced Human Error: Manual trading is prone to human errors such as entering incorrect trade sizes, wrong order types, or missed opportunities due to oversight. Automated trading systems mitigate these risks by executing trades based on pre-defined rules. This reduces the likelihood of costly mistakes caused by human error.

Disadvantages:

- Technical Failures: Automated trading systems rely heavily on technology, and technical failures can occur. Network outages, system glitches, or software bugs can disrupt trading operations and potentially lead to significant financial losses. It is crucial to have robust infrastructure and risk management protocols in place to mitigate such risks.

- Over-Optimization: While backtesting and optimization are valuable tools, there is a risk of over-optimizing trading strategies based on historical data. Strategies that perform exceptionally well in historical testing may not always translate into successful live trading. Over-optimization can lead to curve-fitting, where strategies become too specific to historical data and fail to adapt to changing market conditions.

- Lack of Flexibility: Automated trading systems operate based on pre-defined rules and algorithms. They may struggle to adapt quickly to unexpected market events or sudden shifts in market dynamics. Markets can be unpredictable, and strategies that worked well in the past may not always yield the same results in different market conditions.

- System Complexity: Developing and maintaining an automated trading system requires expertise in programming, data analysis, and financial markets. It can be time-consuming and challenging to build a robust and reliable system. Additionally, ongoing monitoring, updates, and adjustments are necessary to ensure the system remains effective.

- Market Risks: Automated trading systems are not immune to market risks, such as slippage, liquidity issues, or sudden price movements. It is essential to set appropriate risk management parameters and regularly monitor the system’s performance to mitigate these risks effectively.

Conclusion

Automated trading systems offer numerous advantages, including speed, efficiency, emotion-free trading, and the ability to backtest and optimize strategies. However, they also come with disadvantages, such as technical failures, over-optimization risks, inflexibility, system complexity, and market risks. Traders and investors must carefully evaluate these factors and consider their own goals and risk tolerance before deciding to utilize automated trading systems.