In the dynamic realm of financial markets, where microseconds can make or break a trade, a strategy known as latency arbitrage has emerged as a potent technique for gaining a competitive advantage. This approach capitalizes on time lags in trade execution across different markets or platforms to secure profits that result from price discrepancies within fractions of a second. In this article, we delve into the concept of latency arbitrage, exploring its mechanics, advantages, and challenges associated with this cutting-edge trading technique.

Understanding Latency Arbitrage:

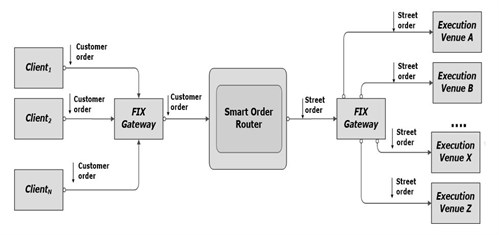

Latency arbitrage involves exploiting the delay in data transmission and trade execution between different exchanges or trading platforms. These delays are often the result of geographical distances, internet connectivity, and the processing times of various systems involved. Traders utilize advanced algorithmic strategies to identify and capitalize on these time lags, allowing them to secure advantageous trade executions.

Strategies Employed:

- Data Feed Analysis: Traders analyze real-time market data feeds from different exchanges to identify instances where price disparities emerge due to latency-related delays.

- Predictive Modeling: Advanced algorithms predict price movements based on historical data, enabling traders to anticipate potential opportunities arising from latency-related price discrepancies.

- Cross-Market Arbitrage: Latency arbitrage can involve trading the same asset on different exchanges, capitalizing on variations in prices due to time delays in execution.

Benefits and Advantages:

- Enhanced Profit Potential: By taking advantage of small price differences that arise from latency, traders can generate profits on a high-frequency basis.

- Reduced Risk Exposure: Latency arbitrage strategies often involve very short holding periods, minimizing the exposure to market volatility and other risks.

- Algorithmic Precision: The success of latency arbitrage heavily relies on algorithmic precision and rapid execution, making it an attractive option for algorithmic traders.

Challenges and Considerations:

- Execution Speed: To succeed in latency arbitrage, traders must have access to ultra-fast execution systems and co-located servers to minimize execution delays.

- Technology Costs: Setting up and maintaining the required infrastructure, including fast data feeds and high-speed servers, can be expensive.

- Market Complexity: As markets become more efficient, true opportunities for latency arbitrage become scarcer, and identifying reliable and consistent opportunities can be challenging.

Conclusion:

Latency arbitrage is a trading strategy that leverages time lags in trade execution to secure competitive advantages in financial markets. While this approach requires advanced technology and sophisticated algorithms, it offers the potential for consistent profits in rapidly changing trading environments. As financial markets evolve, latency arbitrage remains a fascinating avenue for traders looking to capitalize on fleeting opportunities for strategic trade execution.