In the fast-paced realm of financial markets, where prices fluctuate within mere moments, a trading strategy known as high-frequency arbitrage has emerged as a powerful tool for extracting profits from minute price discrepancies. This strategy involves capitalizing on these swift price variations that occur within short timeframes to secure gains that might seem insignificant on an individual basis but accumulate into substantial profits over time. In this article, we delve into the intriguing world of high-frequency arbitrage, examining its mechanics, advantages, and risks involved.

Understanding High-Frequency Arbitrage

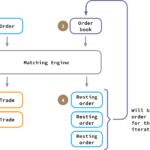

High-frequency arbitrage is a trading technique that exploits price inconsistencies across different markets or platforms. By executing rapid trades in response to fleeting price differences, traders can lock in profits by buying low and selling high, all in a matter of seconds. This approach is made possible by advanced algorithmic trading systems that enable automated execution at lightning speed.

What are the Different Strategies Employed in HFT?

Several strategies fall under the umbrella of high-frequency arbitrage:

- Statistical Arbitrage: This strategy identifies correlations between different financial instruments and trades based on the expected convergence of their prices. Traders leverage mathematical models to identify deviations from the norm and capitalize on these disparities.

- Market-Making: High-frequency traders take on the role of intermediaries, continuously quoting both buy and sell prices for a specific asset. They profit from the spread—the difference between the bid and ask prices—while providing liquidity to the market.

- Triangular Arbitrage: This involves exploiting price discrepancies among three different currencies or assets in a triangular relationship. Traders execute rapid trades to take advantage of momentary imbalances in exchange rates.

Benefits and Advantages

- Speed and Efficiency: High-frequency arbitrage leverages cutting-edge technology to execute trades within milliseconds, enabling traders to capitalize on even the tiniest price differentials.

- Consistent Profits: While individual trades may yield modest gains, the cumulative effect of executing numerous profitable trades adds up significantly over time.

- Reduced Exposure: High-frequency trades are held for very short periods, minimizing the risk exposure associated with overnight positions.

What is Statistical Arbitrage?

Statistical arbitrage is a sophisticated trading strategy that leverages statistical analysis and quantitative models to identify and exploit short-term price discrepancies among related financial instruments. Also known as stat arb or pairs trading, this approach aims to capitalize on deviations from historical or expected relationships between assets, with the goal of generating profits irrespective of the market’s overall direction.

Key Components of Statistical Arbitrage:

- Pairs Selection: The foundation of statistical arbitrage lies in selecting pairs of related assets that historically exhibit a strong correlation. These pairs can be stocks, exchange-traded funds (ETFs), commodities, or any other financial instruments that share a relationship. The correlation suggests that their prices tend to move in tandem over time.

- Cointegration Analysis: Pairs of assets may not always move perfectly in sync due to temporary imbalances. Cointegration is a statistical technique that identifies long-term equilibrium relationships between non-stationary time series data. In pairs trading, the goal is to identify cointegrated pairs where the historical price spread between the two assets tends to revert to its mean.

- Spread Calculation: The spread between the prices of the two assets in a cointegrated pair is calculated. This spread represents the difference between the observed price relationship and the expected relationship based on historical data. When the spread deviates significantly from its historical mean, an arbitrage opportunity may arise.

- Entry and Exit Points: Traders establish positions when the spread widens beyond a certain threshold, indicating a potential reversal to the mean. For example, if the spread is wider than usual, indicating one asset is relatively undervalued compared to the other, a long position might be established in the undervalued asset and a short position in the overvalued asset. The positions are closed when the spread narrows back toward its historical mean.

- Risk Management: As with any trading strategy, risk management is crucial. Statistical arbitrage involves a mix of market risk and model risk. Models can break down if market conditions change, so traders need to implement safeguards to limit losses if a spread continues to widen beyond expectations.

Advantages of Statistical Arbitrage:

- Market Neutrality: Statistical arbitrage strategies are often designed to be market-neutral, meaning they attempt to generate profits regardless of whether the broader market is rising or falling.

- Diversification: By simultaneously trading multiple pairs of assets, traders can diversify risk exposure, reducing the impact of unexpected market moves on their overall portfolio.

- Quantitative Approach: This strategy is rooted in quantitative analysis and data-driven decision-making, reducing emotional biases that can influence trading decisions.

Challenges and Risks:

- Model Risk: The success of statistical arbitrage heavily depends on the accuracy of the models used to identify cointegration and price discrepancies. If the models misinterpret market dynamics, losses can occur.

- Execution Speed: As with all high-frequency trading strategies, execution speed is critical. Rapid execution ensures that traders capture arbitrage opportunities before they vanish.

- Changing Market Conditions: Market dynamics can shift, impacting the relationships between asset pairs. Models built on historical data might not account for sudden changes in correlation.

- Technology Risks: Dependence on complex algorithmic systems exposes traders to the risk of technological glitches or failures that could result in significant losses.

- Regulatory Scrutiny: High-frequency trading has attracted regulatory attention due to concerns over market manipulation and unfair advantages.

- Market Volatility: Rapid price movements can trigger substantial losses if the strategy fails to react quickly enough to sudden market shifts.

What is Market Making in HFT?

Market making is a trading strategy where individuals or firms act as intermediaries between buyers and sellers in financial markets. The primary goal of market makers is to provide liquidity to the market by continuously quoting buy and sell prices for a specific asset. By doing so, they ensure that there is a readily available market for traders to execute their orders, which contributes to smoother market operations and narrower bid-ask spreads.

Key Concepts of Market Making:

- Bid and Ask Prices: In any market, there are two main prices for an asset—the bid price and the ask price. The bid price is the highest price a buyer is willing to pay for the asset, while the ask price is the lowest price a seller is willing to accept. The difference between these two prices is known as the bid-ask spread.

- Liquidity Provision: Market makers commit to both buying and selling a specific asset at any given time. They provide liquidity by narrowing the bid-ask spread, making it easier for traders to execute their orders without significantly impacting the asset’s price.

- Arbitrage and Spread: Market makers profit from the bid-ask spread. They buy an asset at the lower bid price and sell it at the higher ask price. This profit covers their costs and compensates for the risk they take on.

- Risk Management: Market makers are exposed to various risks, including price volatility, market shifts, and the potential for large orders that could move the market against them. To manage these risks, they often use hedging strategies and advanced risk management techniques.

- Algorithmic Trading: In modern markets, many market-making activities are executed through algorithmic trading systems. These algorithms monitor market conditions, adjust quotes, and execute trades in real-time to capture small price differentials.

How Market Making Works:

Let’s walk through a simplified example of market making:

- Asset XYZ: Imagine a market maker is assigned to provide liquidity for Asset XYZ. The current bid price is $10, and the asking price is $10.10, creating a bid-ask spread of $0.10.

- Quoting Prices: The market maker decides to quote bid and ask prices for Asset XYZ. They might quote a bid price of $9.95 and an asking price of $10.05. This narrower spread improves liquidity for traders.

- Order Execution: A trader decides to buy Asset XYZ and submits a market order. The market maker buys the asset at $9.95 (the bid price) and immediately sells it to the trader at $10.05 (the ask price).

- Profit: The market maker’s profit in this transaction is the difference between the bid and ask prices, which is $0.10.

Advantages of Market Making:

- Liquidity Enhancement: Market makers play a crucial role in maintaining liquidity, ensuring that traders can buy or sell assets at any time without causing large price fluctuations.

- Narrower Spreads: By narrowing bid-ask spreads, market makers reduce trading costs for other market participants.

- Reduced Volatility: The presence of market makers can help stabilize prices and reduce sudden price swings that could occur due to low liquidity.

Challenges and Risks:

- Execution Risk: Market makers must quickly adjust their quotes based on changing market conditions to avoid getting caught on the wrong side of a trade.

- Market Shifts: Unexpected market events can disrupt market-making strategies, leading to losses if positions cannot be effectively hedged.

- Regulatory Scrutiny: Market makers need to adhere to regulations to prevent market manipulation and ensure fair trading practices.

What is Triangular Arbitrage in HFT?

Triangular arbitrage is a forex trading strategy that aims to profit from price discrepancies among three different currencies in the foreign exchange market. This strategy takes advantage of the inconsistencies in exchange rates among three currency pairs, allowing traders to generate profits by executing a series of quick trades.

How Triangular Arbitrage Works:

Triangular arbitrage involves three currency pairs, where each currency is paired with the other two. Let’s break down the process with a simplified example:

- Currency Pair A/B: Start with the first currency pair, let’s say USD/EUR. Assume the exchange rate is 0.85, meaning 1 USD can buy 0.85 EUR.

- Currency Pair B/C: Move to the second currency pair, EUR/JPY. Suppose the exchange rate is 130, meaning 1 EUR can buy 130 JPY.

- Currency Pair C/A: Finally, look at the third currency pair, JPY/USD. If the exchange rate is 0.0075, it means 1 JPY can buy 0.0075 USD.

Now, let’s consider an arbitrage opportunity:

- Start with 1 USD: You begin with 1 USD.

- USD to EUR: Convert the 1 USD to EUR using the exchange rate of 0.85, giving you approximately 0.85 EUR.

- EUR to JPY: Convert the 0.85 EUR to JPY using the EUR/JPY exchange rate of 130, resulting in around 110.5 JPY.

- JPY to USD: Convert the 110.5 JPY back to USD using the JPY/USD exchange rate of 0.0075. This yields approximately 0.83 USD.

- Profit: The final amount of USD after the series of conversions is less than the initial 1 USD, resulting in a negative arbitrage opportunity. In other words, if you were able to start with 1 USD and end up with more than 1 USD after the conversions, there would be an arbitrage opportunity to exploit.

If the final amount were greater than 1 USD, you could profit by repeating this process with larger amounts of capital. However, due to the efficiency and competition in the forex market, genuine arbitrage opportunities are usually short-lived and difficult to capture.

Challenges and Considerations:

- Execution Speed: Triangular arbitrage requires rapid execution since exchange rates can change quickly. This is particularly relevant in the context of high-frequency trading.

- Transaction Costs: Transaction costs, including spreads and fees, can significantly impact the profitability of triangular arbitrage trades.

- Market Efficiency: Modern financial markets are highly efficient, and opportunities for triangular arbitrage are often fleeting. Automated trading systems are often used to identify and execute such opportunities quickly.

- Risk Management: As with any trading strategy, risk management is crucial. Sudden market movements or execution delays can lead to losses.

In conclusion, high-frequency arbitrage is a sophisticated trading strategy that capitalizes on price discrepancies within short timeframes. This technique, driven by advanced algorithms and rapid execution, holds the potential for consistent profits. However, it’s essential to acknowledge the associated risks and navigate them with effective risk management practices. As financial markets continue to evolve, high-frequency arbitrage remains a fascinating approach for traders looking to exploit fleeting opportunities for profit.